Renters Insurance in and around San Antonio

Looking for renters insurance in San Antonio?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All San Antonio Renters!

Home is home even if you are leasing it. And whether it's a condo or an apartment, protection for your personal belongings is good to have, especially if you could not afford to replace lost or damaged possessions.

Looking for renters insurance in San Antonio?

Renting a home? Insure what you own.

There's No Place Like Home

Many renters underestimate the cost of replacing their belongings. Your valuables in your rented space include a wide variety of things like your microwave, exercise equipment, tablet, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Raul Benavides III has the efficiency and experience needed to help you examine your needs and help you insure your precious valuables.

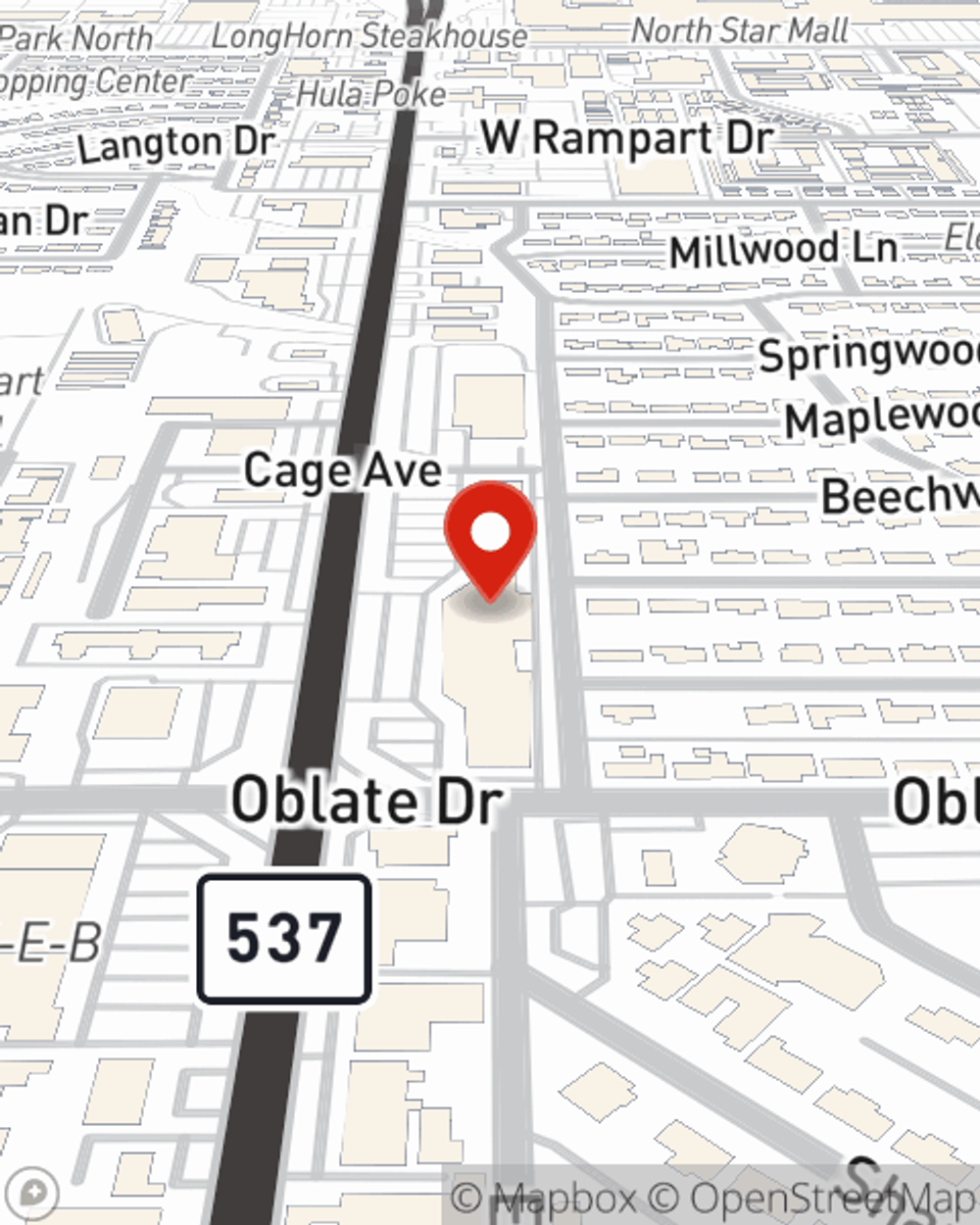

Don’t let concerns about protecting your personal belongings stress you out! Get in touch with State Farm Agent Raul Benavides III today, and see how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Raul at (210) 824-5724 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Raul Benavides III

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.